No, Chugach is not advocating for or against open enrollment. We recognize that descendant enrollment is a decision that will ultimately be determined by Chugach’s voting shareholders. Our goal is to provide shareholders with a clear picture of both the pros and cons of open enrollment, so you can make an informed decision.

FAQ Category: Frequently Asked Questions

What would the voting standard be?

An affirmative vote of shares that represent a majority of the shares present or represented by proxy at the annual meeting would be required to pass an open enrollment resolution.

Who ultimately decides whether open enrollment occurs?

CAC voting shareholders.

Is open enrollment on the ballot for next year’s Annual Meeting?

No, open enrollment is not on the ballot for next year’s Annual meeting, but will be considered for shareholder vote in 2025.

Is a shareholder vote required for descendant enrollment to occur?

Yes.

Why is the Board exploring descendant enrollment?

This issue has been considered by every Alaska Native Regional Corporation, with half deciding to open their rolls. Like our fellow ANCs, Chugach has considered open enrollment for decades, and we would like to open the discussion to our shareholders and descendants to gauge wider, community sentiment.

What are potential impacts to the corporation and shareholders if an open enrollment resolution passes?

The most positive, immediate impact will the inclusion of eligible descendants into the corporation that represents and upholds their heritage and culture. In addition, a larger pool of shareholders, created by issuance of Class E shares, will make it easier to reach Quorum during Annual Meetings, which has become harder and harder to achieve with the passing of Original Shareholders. The financial impact will be increased administrative costs and potentially lower dividends in the short-term, but that will eventually level out and raise as the corporation prospers with an invigorated and enlarged shareholder base.

What is the anticipated financial cost to implement descendant enrollment, if shareholders vote to open the rolls?

We estimate additional costs to prepare the proxy material and bring the matter to a vote. We further anticipate that an increase in the number of shareholders will result in increased administrative costs. Some of those costs will include hiring more staff, printing and mailing more copies of the shareholder newsletters and annual reports, and maintaining more shareholder records.

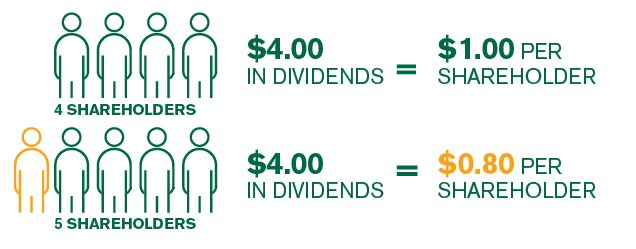

What is dividend dilution?

Dividend dilution is the amount of decrease in dividends a current shareholder would receive if new shares are issued.

For example, say a corporation has $4.00 to pay dividends. If there are four people enrolled in the corporation, they would each receive $1.00. [4 x $1.00 = $4.00]. If you add one shareholder, you have to split the same $4.00 into five shares resulting in each receiving $0.80 per share. [5 x $0.80 = $4.00]. The difference between a $1.00 dividend and an $0.80 dividend is called “dilution.”

What is voting dilution?

If enrollment is opened, descendants of original shares would receive new shares, and they would be able to vote both shares in CAC elections. This would reduce voting strength of original shares, and they would have decreased control in decisions that are voted on at CAC.